The Monthly Bugle - November 2025 Newsletter (Issue #13)

- Dec 2, 2025

- 5 min read

AI Bubble Anxiety

AI Valuations Spark Bubble Worries

It’s no secret that artificial intelligence has been a dominant factor in the S&P 500's historic climb in valuations. Companies like Nvidia, Alphabet (Google’s parent company), and Microsoft have been instrumental in leading the AI boom - and have the revenue to show for it. Nvidia leads the pack with growth of over 62% in the past year alone, but most AI-related companies have enjoyed significant increases in valuations (Macrotrends). It seems like almost every day the S&P 500 is closing at a record high, buoyed by these big AI names.

But as numbers continue to climb, many are starting to wonder if things might be getting out of hand. Recently some big tech names have been making multi-billion dollar deals without the capital to back them up. Managing Partner Stephen Weitzel covers one such deal in our September edition of the Reveille Review; Nvidia, Oracle, and OpenAI have pledged enormous investments in each other, but will they be able to deliver on their promises? AI-related companies now hold so much influence in the market that any bad news could have catastrophic results, especially for investors that have saturated their portfolios with AI stocks.

At Reveille, we highlight the importance of keeping a diversified portfolio and of having a process to help you manage risk. Reach out to us to learn more, or read about our industry-defying Rules Based Investment Discipline on our website.

A Note From COO Michael Bennicelli

Lately, the question we seem get most often is “Are we in an AI bubble?” From my perspective, the short answer is, “definitely.” Markets are at all-time high valuations, indexes are extremely concentrated in AI related names, and the amount of committed investment in AI related projects over the next few years is unfeasible if not impossible. However, navigating the stock market in a period like this isn’t straightforward. George Soros famously said, “When I see a bubble forming, I rush in to buy, adding fuel to the fire,” because early on, there is plenty of profit to be made. But are we in the early, middle, or late part of the cycle? We have our opinions on how much runway is left, but it's impossible to know for sure. Though, when markets do correct – typically in violent fashion – most investors' gains will be imperiled, because they don’t have a process to manage their risk. That’s where we come in. Reach out to us if you want to learn more about how we manage risk for our clients.

In Case You Missed It

Tax Shelter For Business Owners

In a new video, Managing Partner Stephen Weitzel walks through the Big Beautiful Bill and how some of it’s changes may affect business owners. Tune in on Reveille’s YouTube channel here.

Bugle Notes Podcast

Have you caught up with our Bugle Notes podcast? Episode 11 features Hayes Heinecke, RWM Relationship Manager and retired pro baseball player, and Jeremiah Attaochu, former NFL linebacker. Listen on Spotify, or watch on YouTube.

New Reveille Review

October’s Reveille Review is now available on our YouTube channel! Each month, Managing Partners Chad Smith and Stephen Weitzel discuss the previous month’s market news. Watch now on our channel for valuable market insights.

From Our Social Media

Follow us @reveillewealth to keep up to date on all things Reveille!

Around The Office

New Series With Stock Market TV

Exciting news! Reveille and Stock Market TV will be teaming up to bring you a brand new show. Every week, Managing Partner Stephen Weitzel and guests will go live on YouTube to discuss anything and everything related to being a financial advisor. Stay tuned for more details; we can’t wait to get started!

Art Exhibition At Ocala Office

Reveille’s Ocala office recently hosted a meet-and-greet style art exhibition to showcase the work of local artist Stacie Rae Pedrick, in partnership with the Marion Cultural Alliance. Guests enjoyed refreshments and good company while admiring Stacie’s artwork, and there was also a raffle to win an original painting. Thank you to everyone who attended the event, and remember that Stacie’s work is available to purchase at our Ocala office until January.

Stephen Weitzel at ETP Forum

In mid-November, Managing Partner Stephen Weitzel had the opportunity to attend the ETP Forum at the New York Athletic Club in New York City. While attending the event, Stephen participated in a panel discussion with other financial professionals entitled “Options-Powered ETFs: The Derivative Renaissance.” Thank you to ETF Global for putting together a wonderful event!

Ocala CEP Bi-Annual Leaders Luncheon

At the end of October, the Reveille Florida team was proud to sponsor the Ocala CEP Bi-Annual Leader’s Luncheon. At the event, Kathleen Intelisano had the opportunity to share insights from the One Big Beautiful Bill with attendees. It was wonderful to connect with local Ocala business leaders over delicious food. We’re looking forward to the next CEP event!

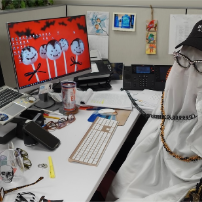

Peachtree City Office Friendsgiving at Fairway Social

In November, Reveille’s Peachtree City office had a Friendsgiving celebration at Fairway Social in Trilith! We had a great time spending time together outside of the office, and of course there was some friendly competition involved. Thank you to Paul Hernandez from Columbia Threadneedle for joining us, and thank you to Fairway Social for hosting us once again.

New Social Media Accounts for Reveille Florida

Big news - our Reveille Florida team now has dedicated social media accounts! Be sure to follow them using the links below to keep up-to-date with everything going on in the Ocala and The Villages offices.

Any opinions are those of Reveille Wealth Management and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

This is not a recommendation to purchase or sell the stocks of the companies mentioned.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Raymond James is not affiliated with any other organization mentioned.

To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line.